Peter & Ian Barnes

9/08/2004 8:25:28 PM

Hi,

I stumbled across this information on a site and thought it was worth posting......

1. Forget the news, remember the chart. You're not smart enough to know how news will affect price. The chart already knows the news is coming.

2. Buy the first pullback from a new high. Sell the first pullback from a new low. There's always a crowd that missed the first boat.

3. Buy at support, sell at resistance. Everyone sees the same thing and they're all just waiting to jump in the pool.

4. Short rallies not selloffs. When markets drop, shorts finally turn a profit and get ready to cover.

5. Don't buy up into a major moving average or sell down into one. See #3.

6. Don't chase momentum if you can't find the exit. Assume the market will reverse the minute you get in. If it's a long way to the door, you're in big trouble.

7. Exhaustion gaps get filled. Breakaway and continuation gaps don't. The old traders' wisdom is a lie. Trade in the direction of gap support whenever you can.

8. Trends test the point of last support/resistance. Enter here even if it hurts.

9. Trade with the TICK not against it. Don't be a hero. Go with the money flow.

10. If you have to look, it isn't there. Forget your college degree and trust your instincts.

11. Sell the second high, buy the second low. After sharp pullbacks, the first test of any high or low always runs into resistance. Look for the break on the third or fourth try.

12. The trend is your friend in the last hour. As volume cranks up at 3:00pm don't expect anyone to change the channel.

13. Avoid the open. They see YOU coming sucker

14. 1-2-3-Drop-Up. Look for downtrends to reverse after a top, two lower highs and a double bottom.

15. Bulls live above the 200 day, bears live below. Sellers eat up rallies below this key moving average line and buyers to come to the rescue above it.

16. Price has memory. What did price do the last time it hit a certain level? Chances are it will do it again.

17. Big volume kills moves. Climax blow-offs take both buyers and sellers out of the market and lead to sideways action.

18. Trends never turn on a dime. Reversals build slowly. The first sharp dip always finds buyers and the first sharp rise always finds sellers.

19. Bottoms take longer to form than tops. Fear acts more quickly than greed and causes stocks to drop from their own weight.

20. Beat the crowd in and out the door. You have to take their money before they take yours, period.

Cheers,

Ian.

Disclaimer: The above mentioned information is my opinion only, and NOT to be taken as advice as i am NOT a licensed advisor. Caveat emptor.

I stumbled across this information on a site and thought it was worth posting......

1. Forget the news, remember the chart. You're not smart enough to know how news will affect price. The chart already knows the news is coming.

2. Buy the first pullback from a new high. Sell the first pullback from a new low. There's always a crowd that missed the first boat.

3. Buy at support, sell at resistance. Everyone sees the same thing and they're all just waiting to jump in the pool.

4. Short rallies not selloffs. When markets drop, shorts finally turn a profit and get ready to cover.

5. Don't buy up into a major moving average or sell down into one. See #3.

6. Don't chase momentum if you can't find the exit. Assume the market will reverse the minute you get in. If it's a long way to the door, you're in big trouble.

7. Exhaustion gaps get filled. Breakaway and continuation gaps don't. The old traders' wisdom is a lie. Trade in the direction of gap support whenever you can.

8. Trends test the point of last support/resistance. Enter here even if it hurts.

9. Trade with the TICK not against it. Don't be a hero. Go with the money flow.

10. If you have to look, it isn't there. Forget your college degree and trust your instincts.

11. Sell the second high, buy the second low. After sharp pullbacks, the first test of any high or low always runs into resistance. Look for the break on the third or fourth try.

12. The trend is your friend in the last hour. As volume cranks up at 3:00pm don't expect anyone to change the channel.

13. Avoid the open. They see YOU coming sucker

14. 1-2-3-Drop-Up. Look for downtrends to reverse after a top, two lower highs and a double bottom.

15. Bulls live above the 200 day, bears live below. Sellers eat up rallies below this key moving average line and buyers to come to the rescue above it.

16. Price has memory. What did price do the last time it hit a certain level? Chances are it will do it again.

17. Big volume kills moves. Climax blow-offs take both buyers and sellers out of the market and lead to sideways action.

18. Trends never turn on a dime. Reversals build slowly. The first sharp dip always finds buyers and the first sharp rise always finds sellers.

19. Bottoms take longer to form than tops. Fear acts more quickly than greed and causes stocks to drop from their own weight.

20. Beat the crowd in and out the door. You have to take their money before they take yours, period.

Cheers,

Ian.

Disclaimer: The above mentioned information is my opinion only, and NOT to be taken as advice as i am NOT a licensed advisor. Caveat emptor.

Light House Super Fund

9/08/2004 8:45:28 PM

Bravo Ian,

Not to sure I (or you) would wholeheartedly agree with all the "NEVER"s & "ALWAYS"s in the list, but most is true. Mr. Market doesn't know never or always.

As controversial as the double tops, I feel #7, if we are talking the same defintions is totally arse about. ie when exhaustion gaps don't fill then they define an island reversal. Similarly if a trend is to continue, then the gap needs to fill, otherwise it is a break-away gap. Could be wrong because I went to a different school.

Also by contravening #13 I can often achieve #20. ??

regards

____________________________________________________________________________________

The above, is either, public domain fact, personal opinion or frivolous fun, not to be taken too seriously. This message discusses market related views but contains no investment advice. If you wish to blame someone for your trading and investment decisions then pay a licensed financial advisor.

Not to sure I (or you) would wholeheartedly agree with all the "NEVER"s & "ALWAYS"s in the list, but most is true. Mr. Market doesn't know never or always.

As controversial as the double tops, I feel #7, if we are talking the same defintions is totally arse about. ie when exhaustion gaps don't fill then they define an island reversal. Similarly if a trend is to continue, then the gap needs to fill, otherwise it is a break-away gap. Could be wrong because I went to a different school.

Also by contravening #13 I can often achieve #20. ??

regards

____________________________________________________________________________________

The above, is either, public domain fact, personal opinion or frivolous fun, not to be taken too seriously. This message discusses market related views but contains no investment advice. If you wish to blame someone for your trading and investment decisions then pay a licensed financial advisor.

Peter & Ian Barnes

10/08/2004 9:41:56 AM

G'day Lite,

I agree, NEVER and ALWAYS are powerful words, especially when we are talking about Mr Market, I've found that just when you grow accostomed to a rule, Mr Market goes and does something totally unexpected just to break your rule. So maybe where those words apear we should replace them with RARELY and OFTEN (?)

As to #7, yep I agree, the wording could be better, and he does seem to have it arse about, it's the Breakaway gaps that RARELY get filled, and the continuation & Exhaustion gaps that OFTEN do. Perhaps i'll start a thread on GAPS aswell, since you and I both enjoy a bit of controversy ;-)

At first glance #20 does apear to be a bit of a contradiction of #13, but what i think he is refering to is more to do with an extention of #3. I think he means that in order to beat the crowd you would have to buy just above support (buy into weakness) and sell just below resistance (sell into strength) because "Everyone sees the same thing and they're all just waiting to jump in the pool."

As for #13, I quite often buy on open, if i miss my entry the afternoon before, or perhaps my setup requires a particular stock to open higher or lower for a trade. But by entering on open, i must be prepared to weather the early morning noise. A good rule to remember is "amateurs open markets, professionals close them" So, entering on open is not advisable, unless you are prepared to weather the storm.

Geoff, as for #10, i think if you can make some money by following these rules, then perhaps you can buy yourself a fishfinder? then when you look, you will be able to tell right away if they are there or not ;-)

Cheers,

Ian.

Disclaimer: The above mentioned information is my opinion only, and NOT to be taken as advice as i am NOT a licensed advisor. Caveat emptor.

I agree, NEVER and ALWAYS are powerful words, especially when we are talking about Mr Market, I've found that just when you grow accostomed to a rule, Mr Market goes and does something totally unexpected just to break your rule. So maybe where those words apear we should replace them with RARELY and OFTEN (?)

As to #7, yep I agree, the wording could be better, and he does seem to have it arse about, it's the Breakaway gaps that RARELY get filled, and the continuation & Exhaustion gaps that OFTEN do. Perhaps i'll start a thread on GAPS aswell, since you and I both enjoy a bit of controversy ;-)

At first glance #20 does apear to be a bit of a contradiction of #13, but what i think he is refering to is more to do with an extention of #3. I think he means that in order to beat the crowd you would have to buy just above support (buy into weakness) and sell just below resistance (sell into strength) because "Everyone sees the same thing and they're all just waiting to jump in the pool."

As for #13, I quite often buy on open, if i miss my entry the afternoon before, or perhaps my setup requires a particular stock to open higher or lower for a trade. But by entering on open, i must be prepared to weather the early morning noise. A good rule to remember is "amateurs open markets, professionals close them" So, entering on open is not advisable, unless you are prepared to weather the storm.

Geoff, as for #10, i think if you can make some money by following these rules, then perhaps you can buy yourself a fishfinder? then when you look, you will be able to tell right away if they are there or not ;-)

Cheers,

Ian.

Disclaimer: The above mentioned information is my opinion only, and NOT to be taken as advice as i am NOT a licensed advisor. Caveat emptor.

Residential Realty Pty Ltd

16/10/2004 6:20:54 PM

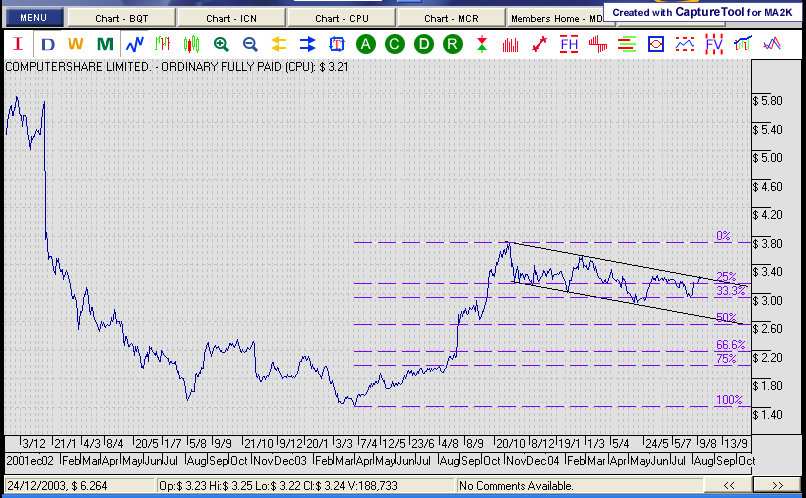

And perhaps RULE # 21 might be ...."a failed signal is a very

powerful indicator"

The attached chart of CPU was accompanied by a post from me circa 13/08/2004 that boldly (brashly?) stated the stock was in a down trend and would continue; WRONG.

sometimes my diet consists of a generous portion of humble pie.............Mick

The attached chart of CPU was accompanied by a post from me circa 13/08/2004 that boldly (brashly?) stated the stock was in a down trend and would continue; WRONG.

sometimes my diet consists of a generous portion of humble pie.............Mick

Udo Stegen

16/10/2004 9:19:29 PM

Great collection, Ian.

it's got my vote for the "gem collection" if ever we get one.

If you don't mind, here are a ten additional suggestions that I've found in my "Archives":

21. Realise that you are never smarter than the market!

22. Do not short sell a stock because you think it’s overvalued!

23. Do not buy a stock because you think it’s cheap.

24. Get to the facts. But make sure they’re expressed in dollars, cents, probabilities, and percent gain. Everything else is opinion or, worse, attempted persuasion.

25. Keep your BS Detector switched on at all times.

26. Don’t chase a trade. A missed trade is money in the bank.

27. Never trade with money you can’t afford to lose.

28. Listen to the "Experts". They'll tell you what can’t be done and why not. Then go and do it.

29. Buy low, sell high. (works just as well on Volume!)

30. Volume precedes Price.

I've also dug out a set of rules that are directed more at Investors.

The Twelve Commandments of Trading

(Thanks to Colin Nicholson)

1. It is important to be diversified. Never put more than 10% of your funds into one stock and no more that 20% into one industry sector.

2. Regularly check how your investments are performing. Look at each one separately, ignoring the overall results for the last period. Be ruthless rather than hopeful.

3. Keep at least 50% of your funds in stocks that pay dividends.

4. Dividend yield is much less important than capital gain for investors as well as traders.

5. Close out losing trades and investments quickly. Be very reluctant to realise profits.

6. Never exceed 25% of your funds in speculative stocks, illiquid stocks, or stocks, about which information is not published regularly.

7. Never invest on the basis of “inside information”. You can be sure you are the last to hear it.

8. Never ask advice about what stocks to buy or sell. Do your own work, based on facts, not the opinions of others.

9. Avoid mechanical formulas and methods for trading or analysing investments. Thinking is hard work, but these things make you intellectually lazy.

10. In boom conditions, move half your funds into short-term bonds.

11. Never borrow heavily to invest, and only borrow when stocks are depressed.

12. Consider putting a small proportion of your funds into long-term options (if available) in promising companies.

Finally, a piece of advice from Phil Carret’s The Art of Speculation:

If you have 1000 shares of a stock worth currently, say, $9, disregard entirely the price you paid for it. Rather ask yourself this question: “If I had $9,000 cash today and wished to buy some security, would I choose this stock in preference to every one of the thousands of other securities available to me?” If the answer is strongly negative, sell the stock! It should not make the slightest difference whether the stock cost you $5 or $13. Your entry price is totally irrelevant, but the average punter gives it considerable weight.

--------------------------------------------

Udo Stegen

I trade daily, but I am NOT a licensed adviser. Even if you find my opinion logical, your actions are solely YOUR responsibility.

it's got my vote for the "gem collection" if ever we get one.

If you don't mind, here are a ten additional suggestions that I've found in my "Archives":

21. Realise that you are never smarter than the market!

22. Do not short sell a stock because you think it’s overvalued!

23. Do not buy a stock because you think it’s cheap.

24. Get to the facts. But make sure they’re expressed in dollars, cents, probabilities, and percent gain. Everything else is opinion or, worse, attempted persuasion.

25. Keep your BS Detector switched on at all times.

26. Don’t chase a trade. A missed trade is money in the bank.

27. Never trade with money you can’t afford to lose.

28. Listen to the "Experts". They'll tell you what can’t be done and why not. Then go and do it.

29. Buy low, sell high. (works just as well on Volume!)

30. Volume precedes Price.

I've also dug out a set of rules that are directed more at Investors.

The Twelve Commandments of Trading

(Thanks to Colin Nicholson)

1. It is important to be diversified. Never put more than 10% of your funds into one stock and no more that 20% into one industry sector.

2. Regularly check how your investments are performing. Look at each one separately, ignoring the overall results for the last period. Be ruthless rather than hopeful.

3. Keep at least 50% of your funds in stocks that pay dividends.

4. Dividend yield is much less important than capital gain for investors as well as traders.

5. Close out losing trades and investments quickly. Be very reluctant to realise profits.

6. Never exceed 25% of your funds in speculative stocks, illiquid stocks, or stocks, about which information is not published regularly.

7. Never invest on the basis of “inside information”. You can be sure you are the last to hear it.

8. Never ask advice about what stocks to buy or sell. Do your own work, based on facts, not the opinions of others.

9. Avoid mechanical formulas and methods for trading or analysing investments. Thinking is hard work, but these things make you intellectually lazy.

10. In boom conditions, move half your funds into short-term bonds.

11. Never borrow heavily to invest, and only borrow when stocks are depressed.

12. Consider putting a small proportion of your funds into long-term options (if available) in promising companies.

Finally, a piece of advice from Phil Carret’s The Art of Speculation:

If you have 1000 shares of a stock worth currently, say, $9, disregard entirely the price you paid for it. Rather ask yourself this question: “If I had $9,000 cash today and wished to buy some security, would I choose this stock in preference to every one of the thousands of other securities available to me?” If the answer is strongly negative, sell the stock! It should not make the slightest difference whether the stock cost you $5 or $13. Your entry price is totally irrelevant, but the average punter gives it considerable weight.

--------------------------------------------

Udo Stegen

I trade daily, but I am NOT a licensed adviser. Even if you find my opinion logical, your actions are solely YOUR responsibility.

Geoff Lynn

7/11/2004 1:19:11 AM

Yeah

dont over trade

dont over analyse if you cant see it dont look for it (you will know what I mean after youve been doing this for a while)

Dont let anyone talk you into or out of a trade

Have Fun

Geoff

dont over trade

dont over analyse if you cant see it dont look for it (you will know what I mean after youve been doing this for a while)

Dont let anyone talk you into or out of a trade

Have Fun

Geoff